Annual Report and Form 20-F 2025

From the Chair

During my time spent with our many stakeholders in 2025, I heard first-hand about the impact of our work and can see how this translates into a strong track record of trust and long-term value creation for investors and all other IHG stakeholders.

From the CEO

I am incredibly proud of our accomplishments and ability to capture travel demand across geographies, chain scales and stay occasions through an unwavering commitment to care, quality and trust that underpins our purpose to provide True Hospitality for Good.

In 2025, we delivered a strong financial performance, with growth in revenue and operating profit supporting a solid increase in adjusted EPS, with over $1.1 billion returned to shareholders.

2025 in reviewFinancial Performance

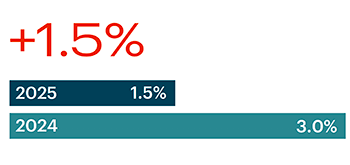

Global RevPAR(a)

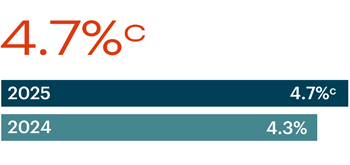

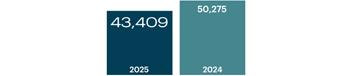

Net SYSTEM SIZE GROWTH

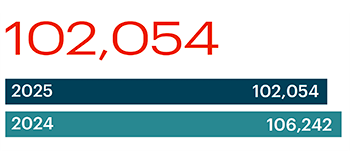

Signings (Rooms)

Total gross revenue in IHG’s System(a)

Revenue from reportable segments(b)

Operating profit from reportable segments(b)

Total revenue

Basic EPS

Operating profit(a)

Adjusted EPS(a,b)

FINAL DIVIDEND PER SHARE

Share buyback completed

a Definitions for key performance measures can be found in the use of key performance measures and non-GAAP measures section, which can be found on pages 107 to 112 in the Annual Report.

b Use of Non-GAAP measures: In addition to performance measures directly observable in the Group Financial Statements (IFRS measures), additional financial measures (described as Non-GAAP) are presented that are used internally by management as key measures to assess performance. Non-GAAP measures are either not defined under IFRS or are adjusted IFRS figures. Further explanation in relation to these measures can be found on pages 107 to 112 in the Annual Report, and reconciliations to IFRS figures, where they have been adjusted, are on pages 250 to 256.

c Net system size growth of 4.7% after adjusting for the impact of removing 7,092 rooms previously affiliated with The Venetian Resort Las Vegas in January 2025. Net system size growth of 4.0% on a reported basis.

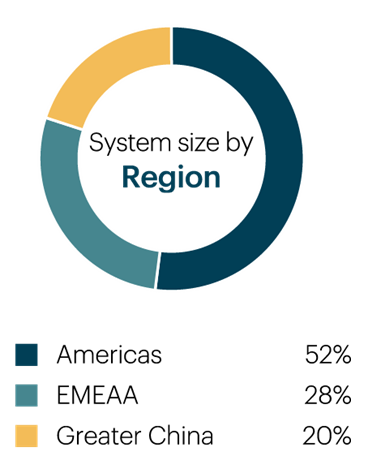

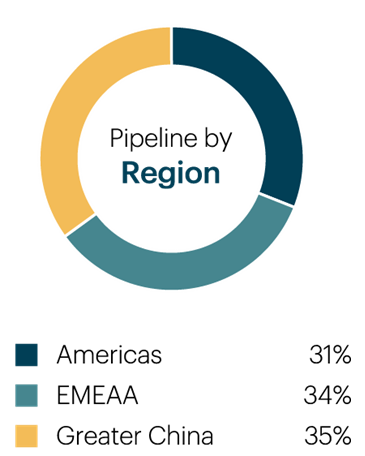

Regional Growth (Rooms)

Americas

EMEAA

Greater China

Americas

EMEAA

Greater China

MICHAEL GLOVER

Chief Financial Officer

From the CFO

The power of our enterprise and operating model delivered our growth algorithm, further reinforcing our track record of driving shareholder returns.

Chief Financial Officer’s Review and Performance

Industry Overview

We operate in an industry with high growth potential, underpinned by strong long-term fundamentals.The global hotel industry remains poised for long-term growth, supported by stable employment markets, robust levels of business activity and resilient leisure demand. While in some countries geopolitical risk and the economic outlook present uncertainties, the overall environment is one that is supportive to the industry.

Our Business Model

We provide an enterprise platform for hotel owners to join the IHG system through a family of 20 hotel brands and IHG One Rewards, one of the world’s largest hotel loyalty programmes. Our overall enterprise, including our brands and technology, meets clear guest needs and generates strong returns for our hotel owners.

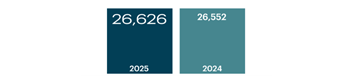

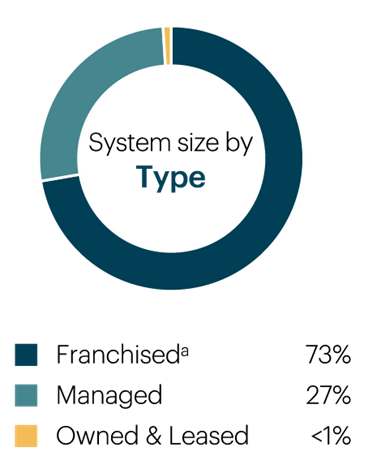

Open Rooms

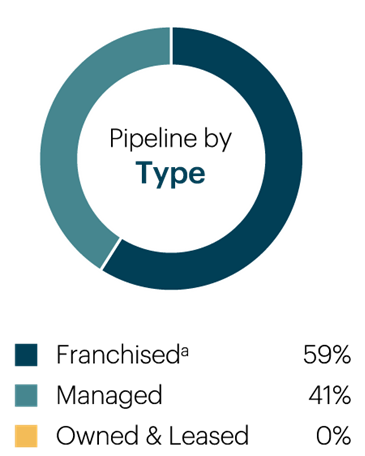

Pipeline Rooms

a Includes Iberostar Beachfront Resorts, which joined IHG's system and pipeline as part of a long-term commercial agreement.

Our Brands

- Luxury & Lifestyle

- Premium

- Essentials

- Suites

- Exclusive Partners

Our Strategy

Our strategy is designed to deliver on our ambition to be the hotel company of choice for guests and owners by capitalising on our investments in our brands, people, technology and scale. Over the long term, with disciplined execution, our strategy drives the growth of our brands in high-value markets. It creates value for all of our stakeholders and delivers sustained growth in profits and cash flows, which can be reinvested in our business and returned to shareholders.

Relentless focus on Growth

Relentless focus on Growth

Brands guests and owners love

Brands guests and owners love

Leading commercial engine

Leading commercial engine

CARE FOR OUR PEOPLE, COMMUNITIES AND PLANET

CARE FOR OUR PEOPLE, COMMUNITIES AND PLANET

Downloads