17 February 2026

Full Year Results for the year to 31 December 2025

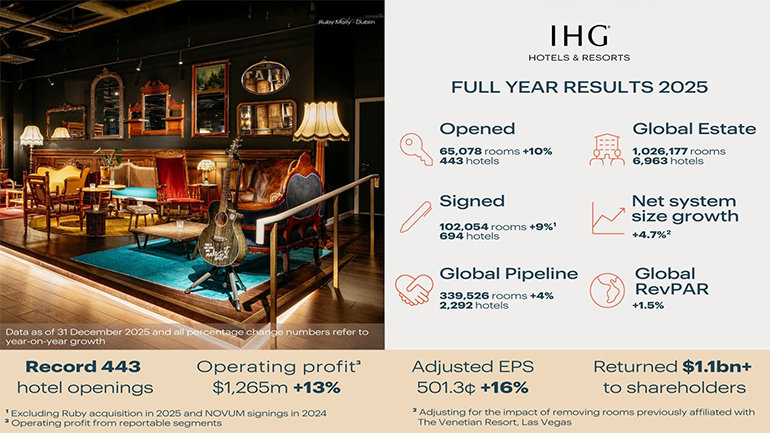

Strong performance with operating profit from reportable segments1 +13% and Adjusted EPS1 +16%; record hotel openings; $1.1bn+ shareholder returns; confident in long-term growth drivers

| 12 months ended 31 December | 2025 | 2024 | % change | Underlying1 % change |

|---|---|---|---|---|

| Results from reportable segments1: | ||||

| Revenue1 | $2,468m | $2,312m | +7% | +6% |

| Revenue from fee business1 | $1,897m | $1,774m | +7% | +6% |

| Operating profit1 | $1,265m | $1,124m | +13% | +12% |

| Fee margin1 | 64.8% | 61.2% | +3.6%pts | |

| Adjusted EPS1 | 501.3¢ | 432.4¢ | +16% | |

| IFRS results: | ||||

| Total revenue | $5,189m | $4,923m | +5% | |

| Operating profit | $1,198m | $1,041m | +15% | |

| Basic EPS | 490.9¢ | 389.6¢ | +26% | |

| Total dividend per share | 184.5¢ | 167.6¢ | +10% | |

| Net debt1 | $3,333m | $2,782m | +20% | |

1.Definitions for non-GAAP measures can be found in the ‘Key performance measures and non-GAAP measures’ section, along with reconciliations of these measures to the most directly comparable line items within the Financial Statements.

Trading and revenue

- Global RevPAR1 +1.5%, with Americas +0.3%, EMEAA +4.6% and Greater China -1.6%

- Average daily rate +0.8%, occupancy +0.5%pts

- Total gross revenue1 $35.2bn, +5%

System size and pipeline

- Gross system growth +6.6% and net system growth of +4.7% adjusting for the impact of removing rooms previously affiliated with The Venetian Resort Las Vegas (net growth of +4.0% on a reported basis)

- Opened 65.1k rooms, up +10% YOY, across a record 443 hotels

- Global estate of 1,026k rooms (6,963 hotels)

- Signed 102.1k rooms (694 hotels), up +9% YOY excluding Ruby acquisition in 2025 and NOVUM signings in 2024

- Global pipeline of 340k rooms (2,292 hotels), up +4% YOY, and represents 33% of current system size

Margin and profit

- Fee margin1 64.8%, up +3.6%pts, driven by positive operating leverage and step-ups in ancillary fee streams

- Operating profit from reportable segments1 of $1,265m, up +13%, including a $1m favourable currency benefit

- IFRS operating profit of $1,198m includes System Fund and reimbursables $46m loss (2024: $83m loss) and $21m exceptional costs (2024: $nil)

- Adjusted EPS1 of 501.3¢, up +16%, includes adjusted interest expense1 of $200m (2024: $165m), an adjusted tax1 rate of 27% (2024: 27%) and a 4.2% reduction in the basic weighted average number of ordinary shares

Cash flow and net debt

- Net cash from operating activities of $898m (2024: $724m) and adjusted free cash flow1 of $893m (2024: $655m), driven by higher profit and lower outflows related to capital expenditure, tax and the System Fund

- Net debt1 increase of $551m, driven by $1.1bn+ of shareholder returns through dividend payments and share buybacks; $120m acquisition spend; $69m foreign exchange adverse impact on net debt

- Adjusted EBITDA1 of $1,332m, +12% YOY; net debt: adjusted EBITDA ratio of 2.5x

Shareholder returns

- $900m share buyback and $270m of ordinary dividends paid to shareholders in 2025

- Final dividend of 125.9¢ proposed, +10%, resulting in a total dividend for the year of 184.5¢, +10%

- New $950m buyback programme launched, which together with ordinary dividend payments is expected to return $1.2bn+ to shareholders in 2026, resulting in cumulative returns of more than $5bn over 5 years

Strong delivery on our clear framework to drive value creation, as set out at the start of 2024

- Targeting compound growth in adjusted EPS of +12-15% annually on average over the medium to long term

- Strong further progress in 2025 on growing our brands, expanding key geographic markets, developing our leading technology and enterprise platform, driving ancillary fee streams, and returning surplus capital to shareholders

- New premium brand — Noted Collection — launched today, and acquisition of urban lifestyle brand – Ruby – are two of many achievements to further strengthen our portfolio and growth potential

Elie Maalouf, Chief Executive Officer, IHG Hotels & Resorts, said:

“Thanks to the hard work of our teams we delivered excellent financial performance in 2025 and in the face of some turbulent trading conditions. There was also further progress on our clear strategy to unlock IHG’s full potential for all stakeholders. We accelerated the growth of our brands, expanded in key markets, strengthened hotel owner returns, drove ancillary fee streams, delivered cost efficiencies and returned surplus capital to shareholders. Collectively, this powered adjusted EPS growth of +16%.

We opened a record 443 hotels in the year and added another 694 into our pipeline, including the highest ever hotel openings and signings in Greater China, as owner demand for our brands continues to increase globally. With over 6,900 open hotels around the world, as we look to the future, our pipeline of a further 2,300 properties is equivalent to system growth of +33%.

We are delighted to launch today our new brand – Noted Collection – in the large and fast-growing premium segment, which I am confident will build on the well-established successes already achieved with our other collection and conversion brands – Vignette, voco and Garner. The launch of Noted Collection follows the acquisition in 2025 of the Ruby brand, which further enriches our Premium portfolio with an exciting, distinct and high-quality offer for both guests and owners in popular city destinations. Ruby signings are growing and this year we have already successfully taken the brand into the US market.

We constantly invest in our powerful enterprise to make sure IHG delivers for guests and owners, including improving and growing our brands and overall portfolio, driving increased loyalty contribution, and rolling out leading technology. Our cash generation and strong balance sheet support our investments to drive growth, and we continue to sustainably increase our ordinary dividend as well as regularly return surplus capital through share buybacks. The Board is pleased to propose a fourth consecutive year of increasing the dividend by +10% and the launch of a new $950m share buyback programme. Cumulatively over five years, this will mean IHG has returned more than $5bn to our shareholders. Supported by attractive long-term industry demand drivers and our proven ability to capitalise on our scale and diverse fee streams across segments and geographies, we enter 2026 with confidence.”

PDF 342 KB Download the full announcement of our 2025 Full Year Results

Ends

About IHG®

IHG Hotels & Resorts (tickers: LON:IHG for Ordinary Shares; NYSE:IHG for ADRs) is a global hospitality company, with a purpose to provide True Hospitality for Good.

With a family of 20 hotel brands and IHG One Rewards, one of the world's largest hotel loyalty programmes with over 160 million members, IHG has more than one million rooms across 6,963 open hotels in over 100 countries, and a development pipeline of a further 2,300 properties.

- Luxury & Lifestyle: Six Senses, Regent Hotels & Resorts, InterContinental Hotels & Resorts, Vignette Collection, Kimpton Hotels & Restaurants, Hotel Indigo

- Premium: voco hotels, Ruby, HUALUXE Hotels & Resorts, Crowne Plaza Hotels & Resorts, EVEN Hotels

- Essentials: Holiday Inn Express, Holiday Inn Hotels & Resorts, Garner hotels, avid hotels

- Suites: Atwell Suites, Staybridge Suites, Holiday Inn Club Vacations, Candlewood Suites

- Exclusive Partners: Iberostar Beachfront Resorts

InterContinental Hotels Group PLC is the Group's holding company and is incorporated and registered in England and Wales. Approximately 400,000 people work across IHG's hotels and corporate offices globally.

Visit us online for more about our hotels and reservations and IHG One Rewards. To download the IHG One Rewards app, visit the Apple App or Google Play stores.

For our latest news, visit our Newsroom and follow us on LinkedIn.

Contact details

For further information, please contact:

Investor Relations:

Stuart Ford (+44 (0)7823 828 739);

Kate Carpenter (+44 (0)7825 655 702);

Joe Simpson (+44 (0)7976 862 072)

Media Relations:

Neil Maidment (+44 (0)7970 668 250);

Mike Ward (+44 (0)7795 257 407)