Annual Report and Form 20-F 2021

From the Chair

The strength of IHG’s business model, strategic investments, pipeline, leadership and passionate teams gives me great confidence in a strong future.

From the CEO

While demonstrating our ability to effectively manage an evolving pandemic, we have not wavered in our focus to build an even stronger IHG, by growing our brands, enhancing our guest and owner offer, supporting our people and communities, and protecting our planet.

in review

in review

Though the pandemic again tested our industry, our resilient business model and people’s desire for travel have shone strongly. Alongside a focus on offering great guest experiences and expert owner support, we are building a stronger, more agile company, investing in our brands, sustainable operations and business, and looking to future growth with confidence.

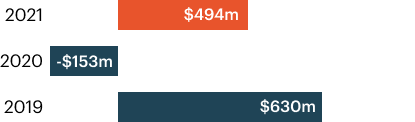

2021 in reviewFinancial Performance

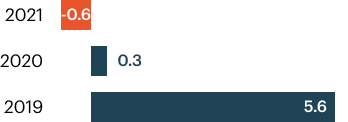

Global RevPAR

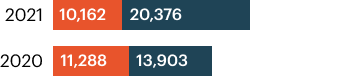

NET SYSTEM SIZE

GROWTH %

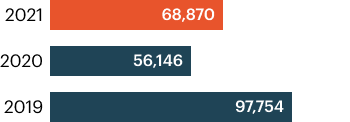

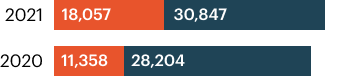

Signings (Rooms)

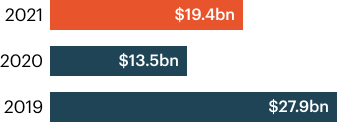

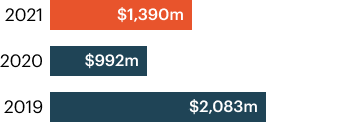

Total gross revenue in IHG’s Systema

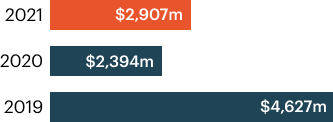

Revenue from reportable segmentsa

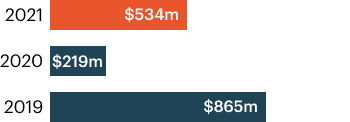

Operating profit from reportable segmentsa

Total revenue

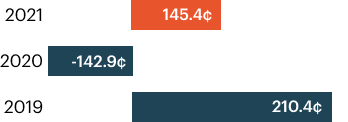

Basic EPSb

Operating profit/(loss)

FINAL DIVIDEND PER SHARE

85.9¢

a Use of Non-GAAP measures: in addition to performance measures directly observable in the Group Financial Statements (IFRS measures), other financial measures (described as Non-GAAP) are presented that are used internally by management as key measures to assess performance. Non-GAAP measures are either not defined under IFRS or are adjusted IFRS figures. Further explanation in relation to these measures can be found on pages 73 to 77 and reconciliations to IFRS figures, where they have been adjusted, are on pages 218 to 223.

b Adjusted EPSa 147.0¢ (+370%); 2020: 31.3¢

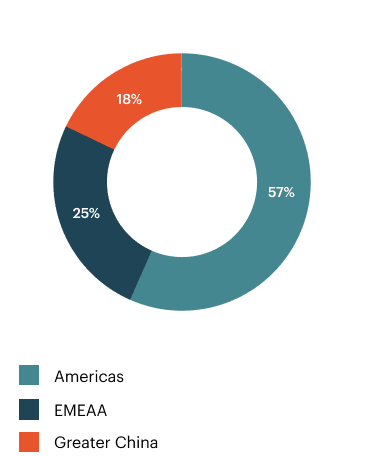

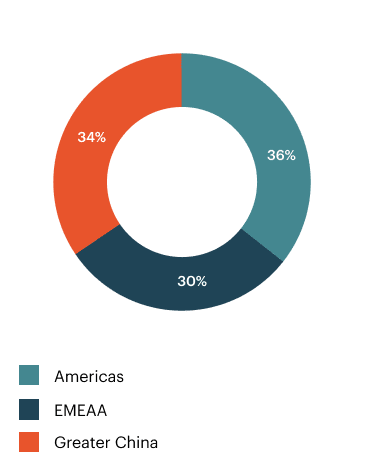

Regional Growth (Rooms)

Americas

EMEAA

Greater China

PAUL EDGECLIFFE-JOHNSON

Chief Financial Officer & Group Head of Strategy

From the CFO

Strong trading recovery in 2021 demonstrating attractive industry fundamentals.

Chief Financial Officer’s Review and Performance

Industry Overview

Despite the challenges of Covid-19, the fundamental desire to travel for business or leisure continues to underpin the industry's growth prospects, illustrated by sustained new hotel opening and signings.

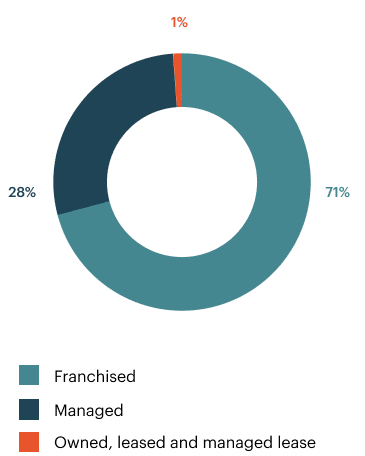

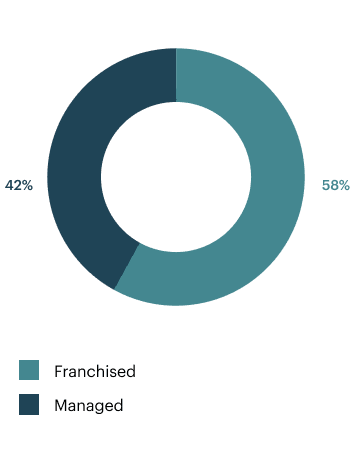

Our Business Model

Operating in more than 100 countries, we predominantly franchise our brands and manage hotels on behalf of third-party hotel owners. As an asset-light business, we focus on growing our fee revenues and fee margins, with limited requirements for capital. Our portfolio of 17 brands has nearly 6,000 hotels and a further 1,800 in the pipeline.

Open Rooms

Pipeline Rooms

Our Brands

- Lifestyle & Luxury

- Premium

- Essentials

- Suites

Our Strategy

Our ambition to deliver high-quality industry-leading net rooms growth is underpinned by strategic investment in our brands, people, systems and scale to drive growth across our portfolio in high-value markets and segments.

The projects that support our four strategic pillars each year are designed to drive performance and growth by helping us create competitive advantage, build richer guest and owner relationships, operate sustainably and responsibly, and enhance a culture that brings the best out of our teams.

Build loved and trusted brands

Build loved and trusted brands

Customer centric in all we do

Customer centric in all we do

Create digital advantage

Create digital advantage

Care for our people, communities and planet

Care for our people, communities and planet

Downloads